Expertise That Works for You

Smart Accounting

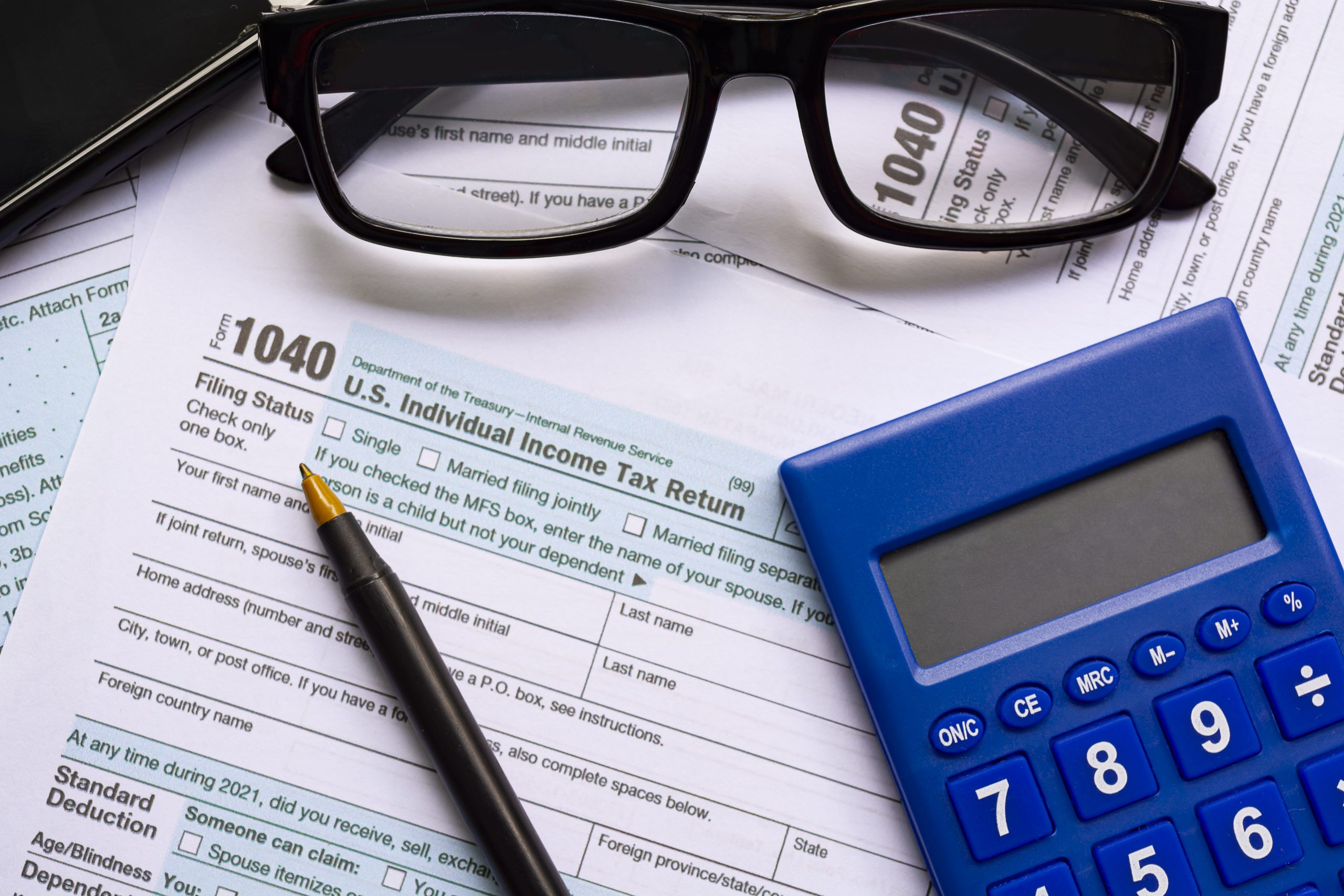

Stress-Free Tax

Our experts manage everything from bookkeeping to corporate tax,

- Comprehensive Bookkeeping

- Tax Planning & Filing

- Financial Reporting

General Enquires

Phone: +971 56 412 0036 & Email: info@wizaccounting.com

Year Of Experience We Just Achived

In the UAE’s fast-changing tax landscape, compliance is no longer optional—it’s essential. At Wiz Accounting, we simplify corporate tax filing with expert guidance, accurate documentation, and timely submissions.

Year of 2010

98%

On-Time Filings

Never miss a deadline with our proactive approach.

To empower businesses across the UAE with complete accounting, tax, and financial solutions that drive compliance, clarity, and confidence.

To be the go-to accounting partner for businesses of all sizes, trusted for simplifying finances and enabling long-term success.

We stand for integrity, excellence, and reliability—helping businesses make smarter financial decisions and grow with confidence.

Corporate Tax Filing

Ensure accurate and timely corporate tax returns with our expert guidance.

- Timely submissions

- Error-free filing

- Penalty prevention

Corporate Tax Filing

Ensure accurate and timely corporate tax returns with our expert guidance.

VAT Registration

Quick and hassle-free VAT registration that aligns your business with UAE...

- Improving Communication

- Employee issue resolution

- Proper Documentation Process

VAT Registration

Quick and hassle-free VAT registration that aligns your business with UAE...

Accounting Services

Comprehensive accounting solutions tailored to meet the needs of businesses of all sizes:

- Financial planning & strategy

- Management & reporting

- Compliance & regulations

Accounting Services

Comprehensive accounting solutions tailored to meet the needs of businesses of all sizes:

Projects Completed

Delivering reliable accounting and financial solutions with precision.

Client Satisfaction

Building lasting relationships through trust and transparency.

Achievements

Reflecting our commitment to delivering value and quality.

Expert Professionals

A strong team of specialists dedicated to client success.

Discover More About Our Accounting Solutions

More About UsExpertise Across All Financial Sectors

Get Appointment

Have questions about bookkeeping, tax filing, or financial planning? Our experts are here to help you every step of the way.

Phone

+971 56 412 0036

At Wiz Accounting, we simplify complex financial tasks so you can focus on growing your business. From bookkeeping to compliance, our tailored services ensure accuracy, transparency, and peace of mind.

Accurate & Reliable Reporting

Get clear insights into your financial health with detailed and timely reports.

Expert Guidance & Compliance

Stay ahead with proactive advice and full regulatory compliance support.

Request A Free Consultation

Demos

Demos  Docs

Docs  Support

Support